Table of Content

On the "Account Details" tab of Online Banking, click "Make a Payment" below your credit card balance to make a payment to your Regions credit card. You then have the option to make the payment from an account at another financial institution. You can apply for a Regions home equity loan or HELOC online, in-person, or over the phone. Before you create an account, though, you can use the bank’s own rate calculator to estimate your rate and monthly payment amount. The good thing about Regions’ physician loan is they offer 100% financing and don’t require you to purchase mortgage insurance. However, both things are expected in a physician loan program so there’s more to consider.

While finding a low interest rate is a priority, you also want to make sure a loan or HELOC doesn’t come with hefty fees, which could offset your savings from a lower rate. Knowing what to expect upfront can help you compare home equity products and find the best deal. If you prefer communicating via online message, you can find the messaging app in either your online account or mobile app.

How to Get a Loan from Regions Bank

Points can be redeemed for hotel stays, concert tickets, gift certificates, products, or even a direct deposit into your bank account. Initially, your balance transfer interest rate will be zero percent. With only proof of future income, you will be eligible for up to $750,000 with no down payment. The bank has over 1,400 branches in 15 states and over 1,900 ATM machines. In fact, Regions is the largest deposit holder in Alabama and Tennessee and runner-up in Arkansas, Louisiana, Mississippi, and Florida.

However, the information regarding their products can be a bit confusing the find on their website, and phone support leaves something to be desired. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation.

Can you get a mortgage with bad credit?

We may, however, receive compensation from the issuers of some products mentioned in this article. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below. With FICO Advanced, you can get the credit score most home lenders actually use plus 25 other commonly used FICO Scores. And, in addition to credit monitoring, you’ll get $1M in identity theft insurance.

Many or all of the offers on this site are from companies from which Insider receives compensation . Advertising considerations may impact how and where products appear on this site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. In most cases, you will be expected to supply information regarding your legal name, date of birth, residence, Social Security number, and annual income. Additionally, there are no fees assessed for purchases made in a foreign country with this card. The scoring formula includes a financial product type as well as tariffs, fees, rewards and other options. © 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved.

Fannie Mae just made it easier to get a mortgage with no credit score

However, Regions offers a Loan in a Line option that allows you to lock in a portion or the entirety of your HELOC at a fixed interest rate during your draw period. The minimum loan amounts for both home equity loans and HELOCs start at $10,000, but home equity loans max out at $250,000 and HELOCs can go up to $500,000. You can have a maximum combined loan-to-value ratio of 80% on HELOCs and a maximum CLTV of 89% on home equity loans.

Emma Woodward is a personal finance writer with a passion for simplifying tricky financial concepts. She has covered loans, budgeting and credit cards for Bankrate, The Financial Diet, Finch, Gusto and Human Interest. When she's not helping you balance your budget, you can find her writing about real estate, food and restaurant tech. Regions Bank doesn’t provide clarity on the minimum credit score needed for a HELOC or home equity loan approval.

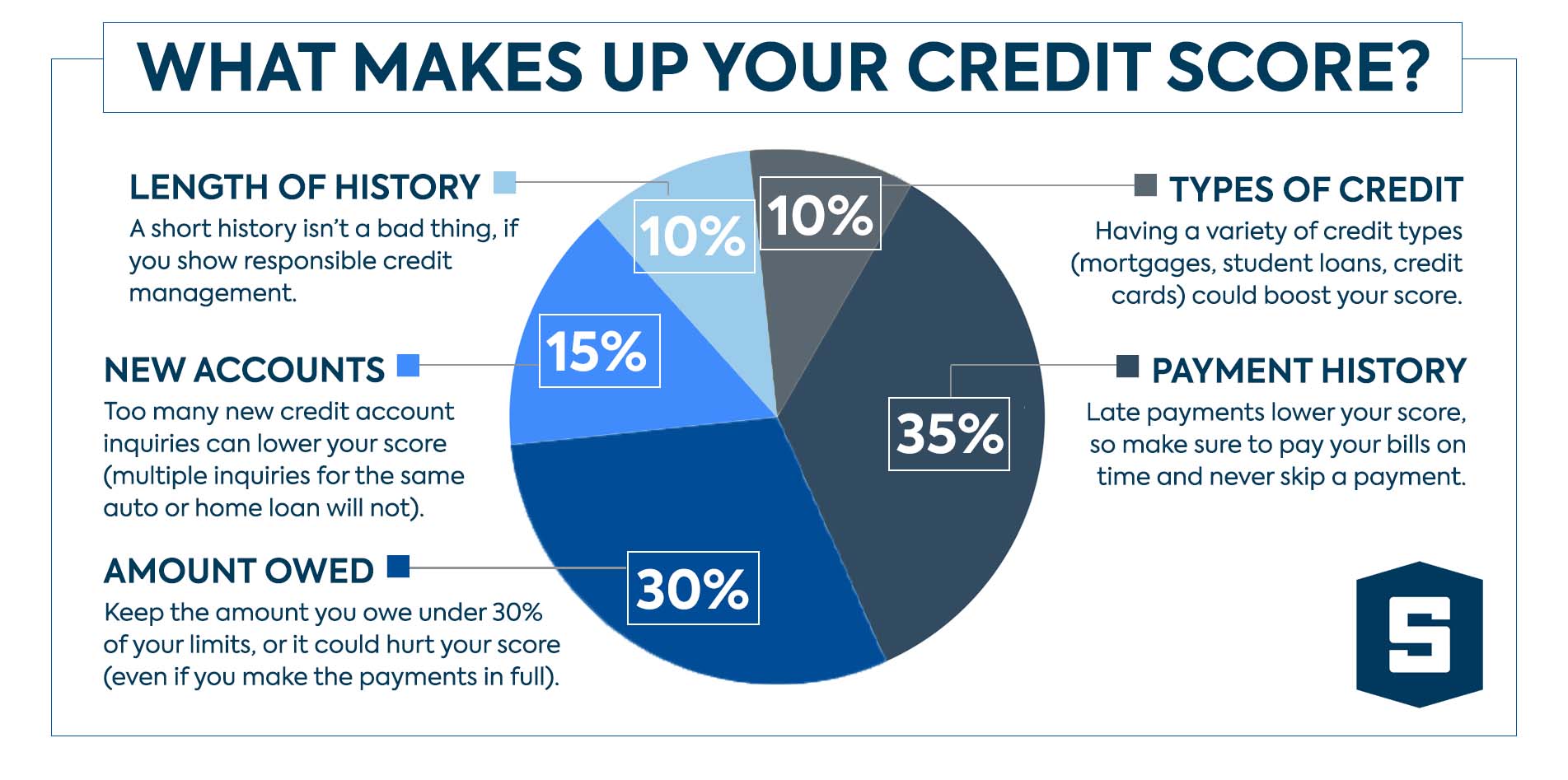

That’s the amount you owe on your credit cards, divided by your total credit limits. For example, if you owe $5,000 on your credit cards, and the total of your credit limits is $10,000, your credit utilization ratio is 50%. The credit bureaus like a ratio below 30%, and the closer you can get to that the better your credit score will be. At 80% and above, the effect is very negative, and even predictive of default. Your best chance of getting a mortgage if you have bad credit is to use an FHA mortgage with a 10% down payment.

Home equity loans typically have fixed interest rates that stay the same over the life of your loan. However, it’s possible to dispute the items and have them removed from your credit report before the seven years. By removing negative items, you can improve your credit score and get approved for the best auto loan rates.

Because they’re subject to government-provided mortgage insurance, credit score requirements are more relaxed. And for that reason, FHA mortgages are more popular among borrowers with fair credit. Regions Bank offers some of the best interest rates that we’ve seen on both home equity loans and home equity lines of credit. They offer a number of rate discounts and have the widest array of ways to access your funds out of the lenders we reviewed.

Our first ever mortgage was with Regions Bank, a VA loan in 1973. We never had a problem, it's been paid off since 1989 and is still reporting. A reputable credit repair company will do all the tedious disputes and follow-ups with the credit bureaus, collection agencies, and creditors for you. You can contact Regions Bank's customer service in a variety of ways -- through social media, messaging app, email, by phone or by visiting a local branch. Regions also has anFAQ page on its website where you can find some of the help you need without having to contact a customer service representative.

No comments:

Post a Comment